Private Credit

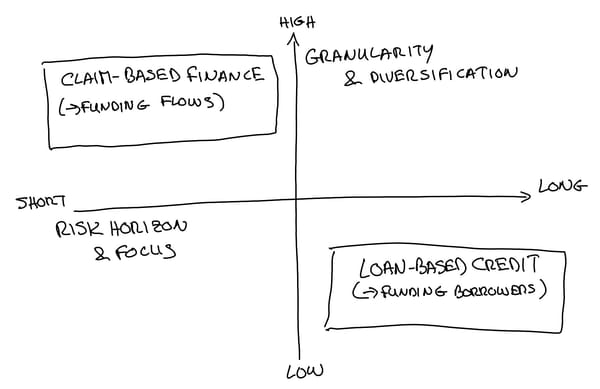

Loan-Based Credit vs Claim-Based Finance: Are You Funding Borrowers or Funding Flows?

Private credit is often treated as one monolithic asset class — but not all “credit” is the same. This article draws the line between loan-based credit and claim-based finance, and shows why distinguishing borrowers from flows changes how you underwrite risk, liquidity, and return.

Private Credit: Risks and Benefits of a Maturity Wall

Model shows how finite-life funds’ ‘maturity wall’ disciplines borrowers and expands credit, shifting risk from banks while raising liquidation risk. Net effect: higher expected output but sharper tail losses, with implications for co-financing, bank portfolios, and policy trade-offs.

Private Credit: From Corned Beef to Tenderloin — Rethinking the Industry Beyond the Headlines

Private credit has become an easy target for sweeping generalisations. Just days after Jared Kushner brokered the USD 55 billion take‑private of Electronic Arts (Reuters), headlines were quick to draw sweeping parallels. The Financial Times framed the First Brands collapse as an 'Enron moment,' while The Economist