Private Credit: Risks and Benefits of a Maturity Wall

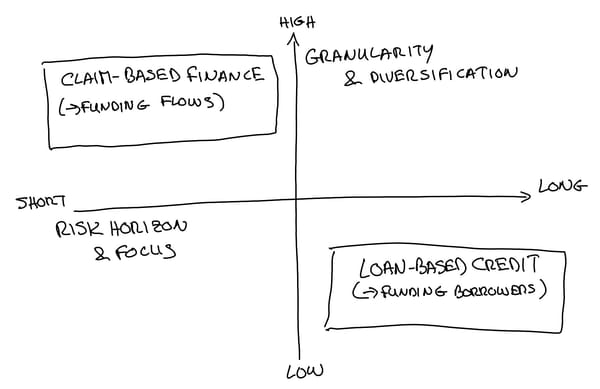

Model shows how finite-life funds’ ‘maturity wall’ disciplines borrowers and expands credit, shifting risk from banks while raising liquidation risk. Net effect: higher expected output but sharper tail losses, with implications for co-financing, bank portfolios, and policy trade-offs.

– 2 min read