Private credit has become an easy target for sweeping generalisations. Just days after Jared Kushner brokered the USD 55 billion take‑private of Electronic Arts (Reuters), headlines were quick to draw sweeping parallels. The Financial Times framed the First Brands collapse as an 'Enron moment,' while The Economist warned of echoes of 2007’s Great Financial Crisis. Yet these criticisms focus on some of the most engineered and opaque corners of the market — the financial equivalent of canned, sodium‑packed corned beef. The reality is more nuanced. Private credit is a diverse and rapidly evolving ecosystem that finances real companies, real assets, and increasingly, real-time transparency. As with a butcher’s counter, what matters is not the label 'meat' but the quality of the cut — whether investors choose a heavily processed product or a lean, healthy tenderloin.

1. From Banks to Alternatives

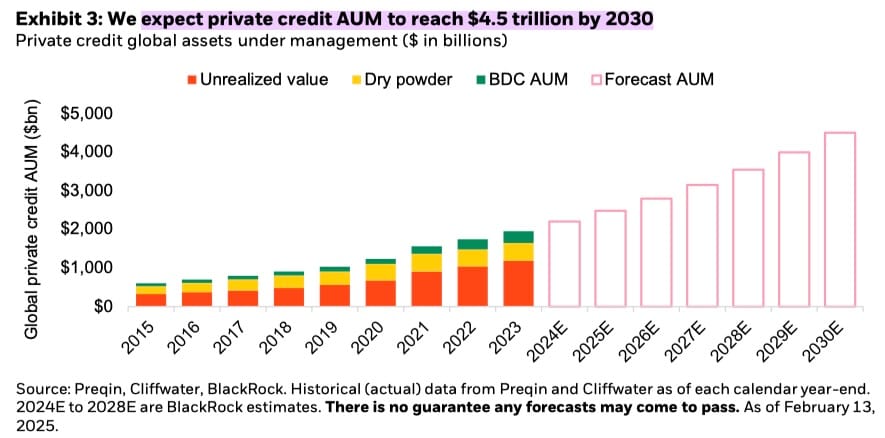

The modern private credit market emerged in the aftermath of the Global Financial Crisis. As banks deleveraged and tightened lending standards, non‑bank institutions stepped in to fill the gap. Having started my career in private credit at Credit Suisse in the early 2000s, I witnessed firsthand how banks once dominated mid-market corporate lending before regulation and capital pressure forced them to retreat. The National Bureau of Economic Research (2024) documents this structural shift: banks’ share of corporate lending in the United States fell from roughly 50 percent in the 1970s to 35 percent in 2023. Stricter capital and liquidity rules under Basel III further discouraged balance‑sheet lending, forcing traditional lenders to withdraw from small‑ and mid‑market borrowers. At the same time, investors sought stable income sources uncorrelated with public markets — a trend amplified by low interest rates and later by inflationary cycles. The result was the birth of a USD 2 trillion asset class that BlackRock (2025) expects to grow to USD 4.5 trillion by 2030.

2. Understanding the Spectrum

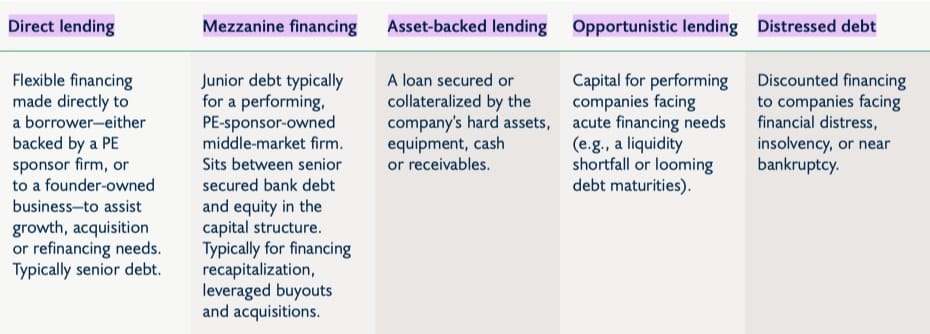

Despite the headlines, private credit is not a monolith. CAIA ('Evolution of Private Credit,' 2024) defines it broadly as “any financing originated, structured, and held directly by a lender,” encompassing direct lending, mezzanine debt, special situations, distressed credit, trade finance, and asset‑based lending (ABL). Each strategy carries distinct risk, duration, and transparency characteristics.

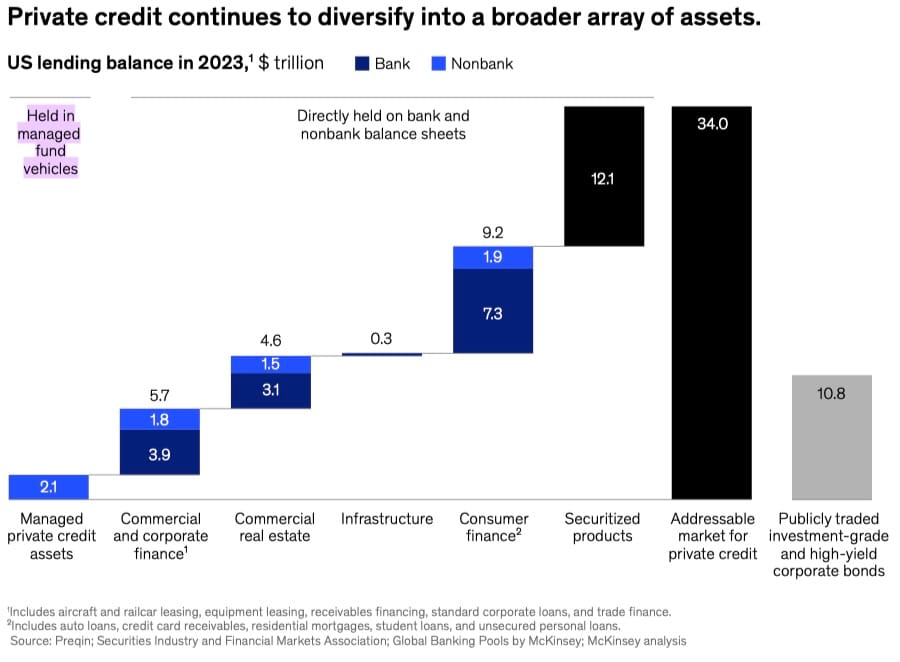

McKinsey (2024) also notes that private credit is expanding its reach into additional assets, suggesting that the size of the addressable market could surpass USD 30 trillion in the United States alone.

BlackRock (2025) underscores this diversity, noting that direct-lending funds targeting middle-market borrowers differ fundamentally from complex, leveraged credit vehicles. In other words, calling all private credit 'risky' is like saying all meat is unhealthy because of processed sausage. Investors should instead evaluate what lies beneath the wrapper — structure, leverage, and transparency.

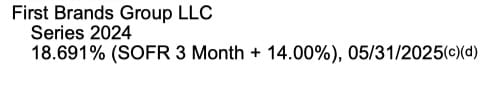

A point in case, AB CarVal’s Credit Opportunities Fund at the end of 2024 showed an all‑in yield exceeding 19 percent.

Such products sit at the processed end of the spectrum, combining layers of engineering and limited liquidity. By contrast, on-balance-sheet receivable financing or short‑term trade finance — closer to the lean tenderloin — typically delivers 9 to 12 percent annualised yields with lower volatility and direct asset backing. Unlike off-balance-sheet factoring, which can obscure cash controls, on-balance-sheet financing maintains daily visibility and alignment between lender and borrower.

3. The rise of asset‑based lending

Among private credit sub‑strategies, asset‑based lending (ABL) stands out for its resilience and innovation. CAIA ('Asset‑Based Lending,' 2024) describes ABL as financing secured by tangible collateral — from inventory and receivables to real assets — where credit risk is mitigated through continuous monitoring of the underlying asset pool. This model has grown rapidly, fueled by demand for more flexible funding structures and advances in data analytics that enable lenders to assess risk in near real-time. The approach aligns the interests of borrowers and investors while offering a transparent yield profile rarely found in leveraged‑loan markets.

As pointed out by the CAIA (2025), asset-based lending has significantly evolved over the past few years and has become an increasingly appealing area for investors. This evolution reflects a flight toward collateral‑backed strategies that combine income generation with capital preservation. Yields in these segments tend to fall in the high single‑ to low double‑digit range, supported by self‑liquidating short‑duration assets. In essence, ABL provides exposure to the real economy — the financing of goods in transit, payables, and receivables — while preserving visibility on cash flows.

4. Technology and Transparency

Technology is quietly transforming private credit from opaque to observable. Blockchain infrastructure now enables the tokenisation of loans, invoices, and receivables, allowing real‑time tracking of ownership and repayment. Such tools enhance auditability and transparency — long-standing weaknesses of the asset class, as noted by S&P Global (2024). At the same time, agentic AI systems are being deployed to monitor borrower performance, flag anomalies, and forecast defaults using transactional data. From AI-driven scoring to automated reconciliation, these innovations are addressing one of private credit’s most persistent criticisms: its opacity.

5. Implications for Investors

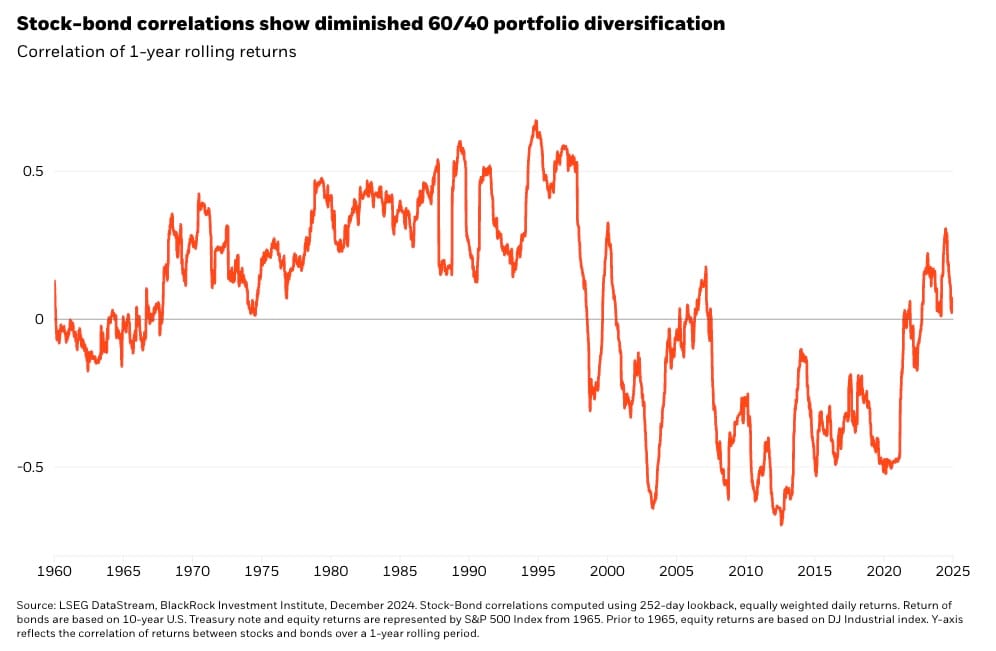

The diversification case for private credit has strengthened as traditional portfolio structures lose resilience. BlackRock (2025) notes that the long‑standing 60/40 portfolio — once the cornerstone of balanced investing — has suffered from rising stock‑bond correlations, reducing its ability to cushion volatility.

In this context, private credit offers a compelling source of steady income and low correlation to public markets. However, the benefits depend on the 'cut' investors choose: leveraged structures with limited transparency can amplify risk, whereas collateral‑backed, data‑driven strategies can enhance portfolio stability. For family offices, wealth managers, and institutional allocators, the imperative is not to shun private credit but to refine due diligence — understanding not just returns but how the sausage is made. These investor groups are increasing allocation to private credit as they seek predictable income and differentiated sources of yield amid volatile public markets.

Conclusion: A Healthy Portfolio Diet

As in nutrition, moderation and discernment matter more than abstinence. Condemning private credit because of a few over‑processed examples ignores its essential role in financing economic growth and diversifying portfolios. The task for investors is to identify the lean cuts — transparent, asset‑backed, technologically enabled strategies — that deliver sustainable yield without excessive risk. With the right tools and oversight, private credit can move from being the misunderstood protein of finance to a key ingredient in a balanced investment diet.

References

· Reuters (2025), "Electronic Arts Goes Private in $55 Billion Deal with PIF and Silver Lake," 29 September 2025.

· Financial Times (2025), "Jim Chanos slams ‘magical machine’ of private credit after First Brands collapse," 30 September 2025.

· The Economist (2025), "Credit Markets Look Increasingly Dangerous," 2 October 2025.

· McKinsey (2024), "The Next Era of Private Credit," September 2024.

· BlackRock (2025), "Private Credit’s Staying Power," March 2025.

· BlackRock (2025), "Rebuilding Resilience in 60/40 Portfolios," March 2025.

· CAIA (2024), "Evolution of Private Credit ," June 2025.

· Alt Institute (2025), “Understanding the Potential of Alternative Investments,” 2025.

· CAIA (2024), "Asset‑Based Lending: Coming of Age in 2020s?," June 2024.

· CAIA (2025), "Four Fantastic Questions About the Private Credit Universe," August 2025.

· NBER (2024), "The Secular Decline of Bank Balance Sheet Lending," Working Paper 32176.

· S&P Global (2024), "Private Credit Casts a Wider Net to Encompass Asset‑Based Finance and Infrastructure," 20 November 2024.

Share this article

Written by

Luc

On-chain credit is quietly rebuilding the fixed-income stack - starting with cash-like products

On-chain credit is quietly rebuilding parts of the fixed-income stack, starting with cash-like, short-duration products. This note explores why tokenization is moving from infrastructure experiments to institutional balance sheets—and why private credit and payments-linked assets may benefit most.

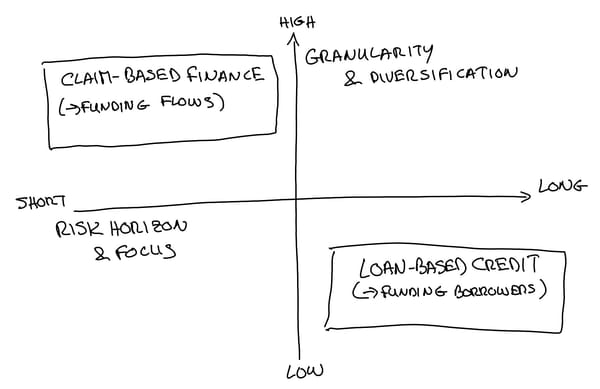

Loan-Based Credit vs Claim-Based Finance: Are You Funding Borrowers or Funding Flows?

Private credit is often treated as one monolithic asset class — but not all “credit” is the same. This article draws the line between loan-based credit and claim-based finance, and shows why distinguishing borrowers from flows changes how you underwrite risk, liquidity, and return.