Luc

Bridging traditional finance and digital assets, I’m a senior investment executive with 20+ years in asset management, fintech, and government advisory.

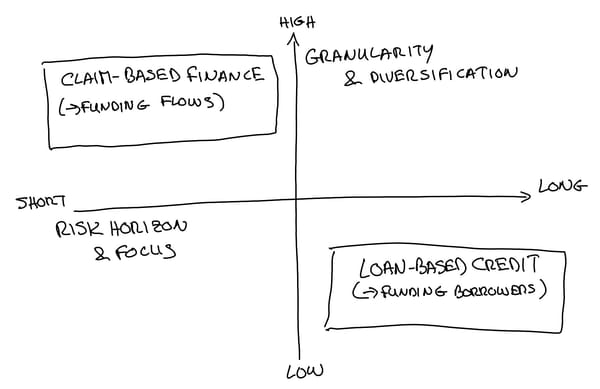

Loan-Based Credit vs Claim-Based Finance: Are You Funding Borrowers or Funding Flows?

Private credit is often treated as one monolithic asset class — but not all “credit” is the same. This article draws the line between loan-based credit and claim-based finance, and shows why distinguishing borrowers from flows changes how you underwrite risk, liquidity, and return.

From “Limited Benefits” to Holy Grail of Cross-Border Payment? Stablecoins in 2025

Stablecoins grew from $20 B to $312 B, moving $27 T a year—but their real test isn’t speed, it’s settlement. Luc Froehlich explains why liquidity, FX, and payout coordination are now the true frontiers of cross-border payments.